KJF Partners is a principal that buys quick service restaurants (QSR’s) with drive-thrus or small footprint, single tenant retail properties that are well located (offering traffic exposure of 25,000+ cars per day), but that have issues making them unattractive to most other investors, such as:

Short lease terms (generally less than 5 years) that create instability or risk for most single tenant buyers.

Above market rents, weak tenants, poorly written leases or environmental challenges—issues that other buyers continue to reject during due diligence.

Stale listings overlooked by brokers and buyers because they have been on the market too long, but the sellers now want to close escrow with certainty.

OUR PURPOSE

KJF Partners creates stable, growing, low-leverage cash flow to help our partners meet their passive income goals.

OUR PRINCIPLES

At KJF Partners we believe integrity in all of our relationships is fundamental to who we are. We believe our principles are proven in our actions, and our actions are what you can measure us by.

We are driven by our personal commitment to create value for our investors, teammates, brokers and tenants.

We communicate honestly and we keep our word.

We cultivate quality relationships through teamwork.

We continually pursue personal growth and learning.

KJF Partners is a cash buyer that believes in earning long term, productive relationships with sellers, brokers, investors and tenants. Net lease brokers and sellers often prefer KJF Partners as their disposition solution because:

![]() KJF Partners is a cash buyer and financing is never an issue. We always have the cash before we make an offer.

KJF Partners is a cash buyer and financing is never an issue. We always have the cash before we make an offer.

![]() Integrity is central to all KJF transactions. We release contingencies on time, close on schedule, and we never put a deal under contract that we don’t intend on closing at our offered price.

Integrity is central to all KJF transactions. We release contingencies on time, close on schedule, and we never put a deal under contract that we don’t intend on closing at our offered price.

![]() KJF is totally transparent in our underwriting and due diligence processes. We’ll keep you informed and up to date at all times.

KJF is totally transparent in our underwriting and due diligence processes. We’ll keep you informed and up to date at all times.

![]() KJF Partners will always provide a long list of quality references before any deal.

KJF Partners will always provide a long list of quality references before any deal.

DEAL STORIES

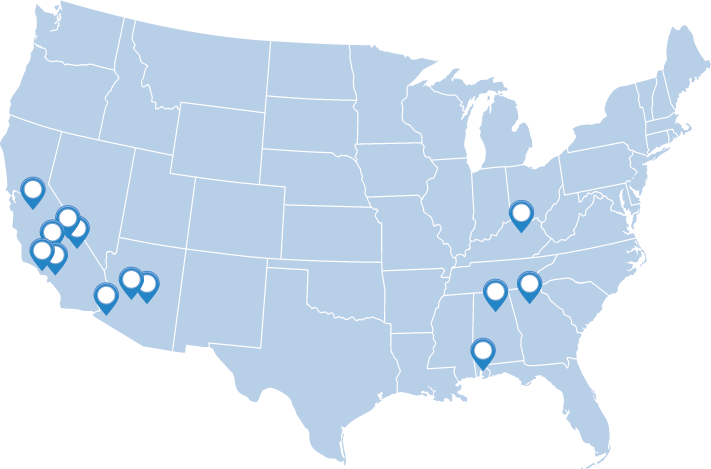

KJF Partners is closing on deals all over the country and creating value for our investors, teammates, brokers and tenants.

Click on any of the images below for insights into KJF Partners deal making process and results.

ACQUISITION CRITERIA

KJF Partners, Inc. buys as a principal, protects and rewards brokers and is aggressively seeking the following investments:

PROPERTY TYPES

1) Quick service restaurants (QSR) w/drive-thru (under 3,000 sq. ft.).

2) Small footprint STNL retail properties (under 5,000 sq. ft.).

AREAS

Strong retail locations nationwide. Well-located properties only, with traffic of 25,000+ cars per day (cpd) and other major retailers and nationally recognized QSR’s in the immediate vicinity.

PRICE RANGE

$1.5 million and under.

MAJOR OBJECTIVE

Creation of stable, long term cash flow and future value.

PARAMETERS

Prefer leases with less than five years remaining on total term with below market rents. We will consider well located properties with issues such as: over-market rents, short lease terms, termination clauses, sub-standard franchisees and local or regional tenants.

RECENT ACQUISITIONS & ESCROWS

QSR’s w/Drive-Thru:

Memphis TN; Phoenix AZ; Mobile AL; Lexington KY; Marietta GA; Modesto CA; Yuma AZ; Scottsdale AZ; Long Beach CA; Fountain Valley CA.

Other Retail:

Apple Valley CA – 5,000 sq. ft. Banner Mattress;

Albertville AL – 4,000 sq. ft. Verizon Wireless;

Hesperia CA – 3,750 sq. ft. hard corner w/3 tenants.